If you’re lucky enough to have suppliers who let you hold inventory on consignment, good for you!

Having inventory that you don’t have to pay for until after it’s sold is great for cash flow. However, if you don’t do things right in Fishbowl, consigned inventory is not so great for your accounting records. In fact, it can make a real hash out of your QuickBooks numbers. To avoid problems, here’s what you need to do…

1. Bring inventory into Fishbowl at its eventual cost.

Logically, you may think that consigned inventory should be brought into Fishbowl at zero cost. After all, until it sells, the cost to you is zero. But if you bring consigned inventory into Fishbowl at zero cost you mess up your costing layers, making it impossible to calculate an accurate cost of goods sold. To keep these calculations accurate you need to use the eventual cost.

2. Create a “Consignment Allowance” account in.

Bringing consigned inventory in at eventual cost solves the cost of goods sold problem but causes another problem. Unless you take additional steps to compensate, your inventory and accounts payable will both be overstated, because they will include the value/cost of inventory that you have not yet purchased.

The solution to this is to create a new account in called “Consignment Allowance.” The balance in this account should be the value of the inventory received on consignment, for which title has not yet transferred. This is a credit balance account that will offset the inventory asset.

3. Modify the bill created in QuickBooks.

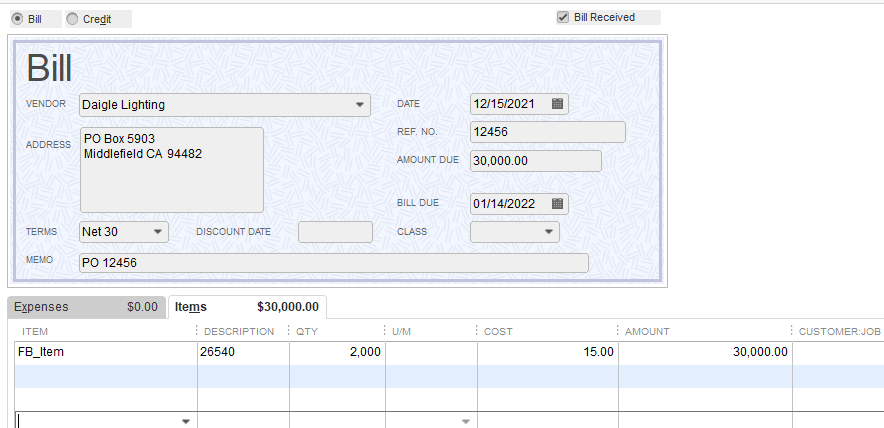

Inventory in Fishbowl automatically creates a bill in QuickBooks. Even though the title in this case has not yet transferred, this bill serves as a “place marker” in QuickBooks to remind you that you have this inventory in your possession.

When this bill is created in QuickBooks, your inventory asset and Accounts Payable accounts are both increased (i.e. the bill creates a debit to inventory and a credit to Accounts Payable).

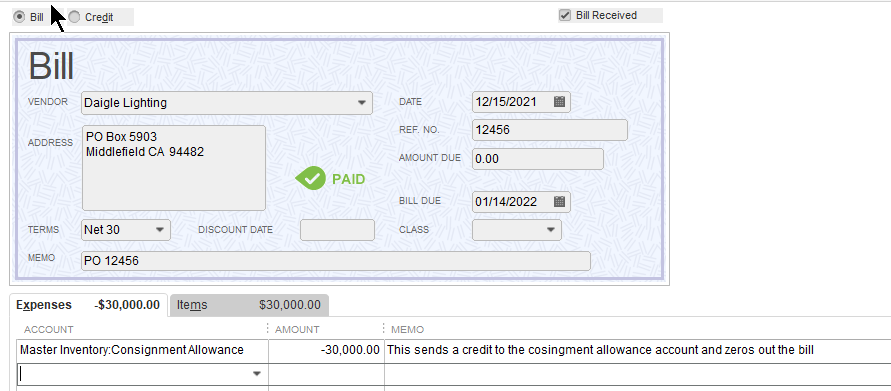

However, at this point in time since you have not taken title to this inventory, you do not owe any money to the vendor for it. You therefore need to modify this automatically-created bill so that you zero out this credit to Accounts Payable. To accomplish this:

- Open up the bill

- Go to the Expenses tab

- Enter the amount of the bill as a negative number, and code this to the Consignment Allowance account.

Once you modify the bill in this way your Accounts Payable balance will be an accurate reflection of what you owe, and your Net Inventory balance will be an accurate reflection of what you own.

4. Enter vendor bill into QuickBooks.

Based on the terms of your contract with the consigning vendor, you will periodically send them a report of what has been sold, and they will respond by sending you a bill.

When you receive these bills, keep in mind that they have nothing to do with Fishbowl or your inventory counts; these are strictly Accounts Payable matters. Do not enter anything from these bills into Fishbowl.

When you receive a vendor bill, enter it into QuickBooks using the Consignment Allowance account on the Expenses tab. Do NOT enter this using the individual inventory items on the Items tab. By the time the items have sold, the sale (and its impact on inventory and cost of goods sold) will have already taken place within Fishbowl. You’re just going into QuickBooks to make your final payment for the inventory to which you took title.

.png)